Cash-Out Refinance vs. HELOC: Which Home Equity Option Makes Sense in 2025?

Quick takeaway for 2025 homeowners (read this first)

If you’re weighing cash-out refinance vs. HELOC, the real question is simple: do you want to change your mortgage or add a second loan next to it? A HELOC (a home equity line of credit) keeps your first mortgage intact and adds a separate balance with its own payment. A cash-out refinance replaces your current mortgage with a new one, usually changing your interest rate, term, and monthly payment.

- Pick a HELOC if you want to keep your existing mortgage rate, need flexible access to cash, or expect to pay the balance down fast.

- Pick a cash-out refinance if your current mortgage rate is already high, you want one predictable payment, or you’re comfortable resetting the loan term.

- Either way, compare the total monthly payment, fees, and worst-case rate scenarios. Lenders price these products differently, and small terms matter.

The “3% first mortgage” problem (why this comparison exploded post-2022)

A lot of homeowners are sitting on low fixed first mortgages. Refinancing can raise the interest rate on money you already borrowed cheaply.

If you only read one rule of thumb

If your current mortgage rate is great, HELOC vs cash-out refinance usually leans HELOC. If your current rate is not great, a cash-out refinance vs. HELOC can lean refinance.

Cash-Out Refinance vs. HELOC Explained

Think of a HELOC loan vs. a cash-out refinance as two totally different moves on your house financing.

How a cash-out refinance works (replace + take cash)

A cash-out refinance (often called a cash-out refi) replaces your first mortgage with a new mortgage. The new loan is larger than what you currently owe, and you receive the difference as cash at closing. Because it’s a brand-new mortgage, the lender will typically re-check your income, credit, and home value, often through an appraisal.

What changes: term, rate, payment, principal

- Term: You may reset the clock back to 15 or 30 years.

- Rate: Your interest rate updates to today’s market, for better or worse.

- Payment: Your monthly payments change because the loan amount, rate, and term changed.

- Principal: Your total mortgage balance increases by the cash you take out (plus any financed costs).

How a HELOC works (second mortgage revolving line)

A HELOC is a second mortgage that works like a revolving credit line. You keep your first mortgage exactly as is, then you borrow against your equity up to a limit. Your payment is separate from your first mortgage payment, and the rate is commonly one of those variable interest rates that can move over time.

Draw period vs repayment period (and what “interest-only” really means)

During the draw period, you can borrow, repay, and borrow again. Many HELOCs let you make interest-only payments during this phase, which means you are covering interest but not reducing the balance much. In the repayment period, borrowing usually stops, and you pay principal plus interest on what you owe.

That’s the core difference between HELOC and refinance cash-out: one replaces your mortgage, the other adds a line next to it.

Side-by-side comparison table (structure, rates, fees, flexibility)

When you compare cash-out refinance vs. HELOC pros and cons, don’t get stuck on one headline number. The “cheaper” option depends on what you’re really buying: a new first mortgage on the full balance or a second-lien line of credit on just the portion you borrow. Fees, rate type, and how long you’ll carry the balance usually decide it.

Comparison table: lump-sum vs line of credit, fixed vs variable, one payment vs two

| Feature | Cash-Out Refinance | HELOC | Home Equity Loan (for context) |

|---|---|---|---|

| Basic structure | Replaces your first mortgage with a new, larger mortgage | Second lien revolving line added on top of your first mortgage | Second lien lump-sum loan added on top of your first mortgage |

| How you get the money | One lump sum at closing | Draw as needed up to a credit limit | One lump sum at closing |

| Interest rate type | Often fixed (can be adjustable depending on product) | Usually variable interest rate | Usually fixed |

| What your payment looks like | One combined mortgage payment | Two payments: first mortgage + HELOC | Two payments: first mortgage + home equity loan |

| Fees | Closing costs and lender fees on the full new mortgage are common | Often lower upfront costs, but watch annual/maintenance fees and early-close clauses | Closing costs may apply, often smaller than a full refi |

| Best fit for | You want one payment, fixed terms, or your current mortgage rate is not great | You want to keep your first mortgage and borrow flexibly | You want a fixed rate without refinancing the first mortgage |

| Main risk to plan for | Resetting term; paying today’s rate on a larger balance | Rate changes; payment jump after draw period; discipline around revolving credit | Less flexible; fixed payment even if you didn’t need the full lump sum |

2025 rate + cost reality check (what you actually pay)

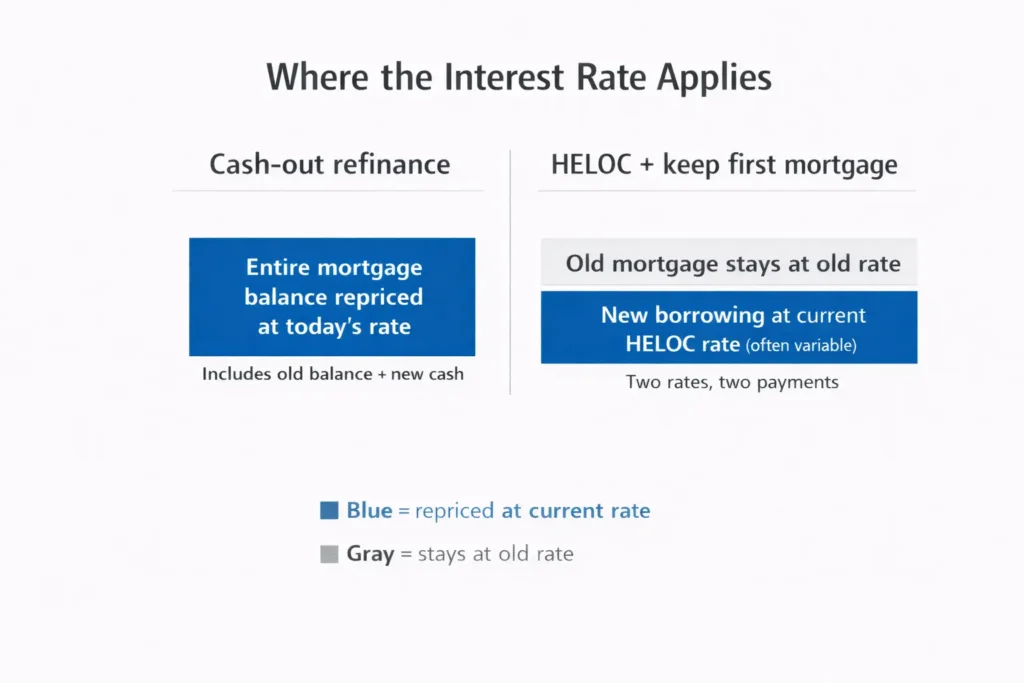

When you compare heloc vs cash out refinance, most people fixate on the headline interest rate. That’s understandable, but it can lead you to the wrong choice. In 2025, the bigger money question is usually where the rate applies.

A cash-out refinance gives you a new first mortgage. That means the new rate is applied to the entire refinanced balance, not just the cash you wanted. A HELOC applies its rate only to the amount you actually draw from the home equity line of credit, while your existing first mortgage keeps its original rate. If you’re sitting on a low first-mortgage rate from a prior purchase or refinance, this difference alone can swing the math.

Closing costs: why refis feel expensive (and when they’re worth it)

A mortgage refinance comes with real friction: lender fees, title work, and often an appraisal and other closing steps. You’re basically doing a new mortgage closing again, so closing costs can feel heavy because they’re tied to the full loan size, not just the extra cash you need.

A refinance can still be worth it when the new terms help you on the whole loan, not just the cash-out portion. The cleanest case is when your current mortgage rate is already high, and the refinance improves your overall financing. In that situation, you’re not just “buying cash,” you’re reshaping the full mortgage.

HELOC costs: intro promos, annual fees, early-close clauses (what to watch)

A HELOC is often cheaper to start, but it’s not automatically “cheap.” Lenders may advertise teaser promos, but you’ll want to scan the fine print for things like annual fees, minimum draw requirements, rate floors, and early-closure clauses (some charge a fee if you close the line too soon). Also, many HELOCs use variable interest rates, so your cost can change after you open it even if your balance stays the same.

The blended-rate concept (keep cheap debt cheap)

Here’s the practical way to think about refinance with cash out vs heloc: you’re building a blended interest picture.

- With a cash-out refinance: one big balance, one rate.

- With a HELOC: two balances, two rates, one combined household payment.

If your first mortgage rate is much lower than today’s borrowing rates, the blended approach often keeps your total cost lower because most of your debt stays at the cheaper rate.

Mini-example math setup (the numbers we’ll reuse later)

- You owe $X on your first mortgage at Y%.

- You need $Z in cash.

- Cash-out refi path: the new mortgage becomes $X + $Z at today’s rate, plus closing costs.

- HELOC path: keep $X at Y%, add a HELOC balance of $Z at a variable (or partially fixed) rate.

Next, we’ll plug real numbers into this setup and compare the monthly payment and long-run interest paths side by side.

The flagship math example (payment comparison table)

Numbers make the trade-off clear, so here’s one clean example you can copy into our cash out refinance vs heloc calculator (and then swap in your real balances, rates, and fees).

Example setup (illustrative, not a rate forecast):

You owe $250,000 on your mortgage loan at 3.25% with 25 years left. You need $60,000 cash.

Example: keep the first mortgage vs refinance the full balance

| Metric | Cash-out refinance (new first mortgage) | Keep first mortgage + HELOC (interest-only phase) |

|---|---|---|

| New principal | $310,000 | $250,000 first + $60,000 HELOC |

| Assumed interest rate | 6.75% fixed | 3.25% first; 9.25% HELOC (variable) |

| Term used for math | 30 years | First stays 25 years; HELOC is interest-only in draw |

| Monthly payment (principal + interest) | $2,010.65 | $1,218.29 + $462.50 = $1,680.79 |

| Total interest in Year 1 (illustrative) | $20,824.03 | $8,027.38 + $5,550.00 = $13,577.38 |

| Break-even notes | You’re paying the new rate on the entire balance | You’re paying the higher rate only on the new $60k |

A few important guardrails: this ignores taxes/insurance and assumes rates stay unchanged for the year. It also excludes closing costs, which matter a lot in refinancing because you’re refinancing the full balance. If your first mortgage rate is already low, this is why the HELOC path often looks better on short- and medium-term math, even when the HELOC rate is higher.

How to decide in 10 minutes (use our calculators)

You can make this choice fast if you run both options with the same inputs. Start with our cash-out refinance vs. HELOC calculator, then pressure-test your result with the fee sheet from your lender. This keeps the decision grounded in your actual numbers, not a generic headline rate.

Step-by-step: run both scenarios side-by-side

Inputs you’ll need (home value, loan balance, rate, LTV, cash amount)

- Home value (estimate + the value your lender will likely use after appraisal/valuation).

- Current loan balance and your existing interest rate on the first mortgage.

- How much cash you want (your cash amount).

- Your target loan-to-value (LTV) or combined LTV if you’re adding a HELOC.

- A realistic HELOC rate quote and a refinance rate quote from lenders you’d actually use, plus any lender credits.

Outputs to compare (payment now, payment later, total interest, fees)

- Month one reality: what’s the refi payment if you do it today, and what’s the “two-payment” total if you keep the mortgage and add a HELOC?

- Future reality: HELOC payments can change when the draw period ends, so run that version too, not just the interest-only phase.

- Interest payments: compare first-year interest and a longer view (5–10 years) if you’ll carry the balance.

- Fees and closing costs: refinance closing costs, HELOC annual fees, early-close clauses, and any minimum draw rules.

Decision triggers (keep low rate, need flexibility, hate variable rates, etc.)

- If your first mortgage rate is low, refinance cash-out vs. HELOC often leans toward HELOC because you avoid repricing your whole mortgage.

- If you want one predictable payment and a fixed structure, a cash-out refi can fit better.

If variable rates make you nervous, model a “rate goes up” case on the HELOC before you commit.

When a HELOC usually wins (2025 use cases)

A HELOC is not “better” in every situation, but it often wins on real-life practicality. Especially when the goal is to tap equity without rewriting your whole mortgage. If you’re comparing heloc vs refinance cash out, these are the cases where a home equity line of credit tends to fit best.

Renovations in phases (draw as needed)

Big projects rarely happen in one clean payment. You might pay a deposit, then another draw when materials arrive, then a final payment after inspections. A lineofcredit matches that rhythm. You borrow what you need, when you need it, and your payment is based on what you’ve actually drawn, not the full approved limit. That’s the core advantage of a HELOC loan vs cash out refinance for phased work.

Emergency liquidity without touching your first mortgage

Some homeowners open a HELOC and leave it unused as a backup plan. If life hits hard, medical bills, job gap, surprise repair, you can access cash without replacing your first mortgage or paying refinance closing costs. You still need discipline because it’s real debt, but it’s a flexible safety net when your household budget needs breathing room.

Short payoff horizon (bridge financing)

If you expect to pay the balance off quickly, a HELOC can behave like a bridge. Maybe you’re waiting on a bonus, a tax refund, a home sale, or you just plan to knock it out within a year or two. In that window, keeping your first mortgage intact and only paying today’s interest rate on the smaller borrowed amount can be easier to stomach than refinancing your entire loan.

When a cash-out refinance can be smarter

A HELOC gets a lot of love in 2025, but cash-out refinance vs heloc isn’t a one-answer question. A cash-out refinance can be the cleaner move when you’re not protecting a great first rate, or when you want the simplicity of one long-term structure.

Your current mortgage rate is already high (refi improves the whole loan)

If your first mortgage rate is already high, a mortgage refinance can improve the cost of the entire balance, not just the cash you need. That’s a different story than the “don’t touch your 3% mortgage” crowd. Here, refinancing doesn’t just buy cash, it can reshape your full loan economics, especially if you’re also adjusting term or removing mortgage insurance. Your available equity and loan-to-value limits still matter, but the logic is straightforward: if the new rate meaningfully improves the full loan, the refinance can earn its keep.

You need one fixed payment and plan to hold long-term

A cash-out refinance often gives you one payment, one due date, one loan to manage. If you’re the type of homeowner who values predictability, that matters. You’re not juggling a separate HELOC payment, and you’re not exposed to the same kind of variable-rate movement on the borrowed portion. If you plan to keep the home and the mortgage for years, locking a stable structure can be worth more than squeezing every last dollar out of short-term math.

You want to reset term intentionally (not accidentally)

Refinancing resets your schedule. That can be good or bad depending on your intent. If you reset to a longer term without thinking, you may pay more total interest even if the monthly payment feels easier. But if you’re doing it on purpose, for example, to lower required payments while you rebuild cash reserves, or to align your payoff timeline with retirement, then a planned term reset can be a feature, not a mistake. The key is to watch how much principal you’re carrying, and what the new term does to your long-run cost.

Lender policy reality in 2025 (what banks look at)

Whether you’re comparing cash out refinance vs heloc, banks underwrite one thing first: risk. They want to know you can repay, and they want enough equity if they ever have to enforce the lien. A HELOC is usually treated like a second mortgage. A cash-out refi becomes the new mortgage loan.

Common approval factors (credit score, DTI, income, LTV/CLTV)

Most lenders start with credit and income stability. Not just “what you earn,” but how predictable it is. Then they look at debt-to-income (DTI). High DTI makes approvals harder and pricing worse.

Equity is the other big gate. That’s where loan-to-value (LTV) and combined LTV (CLTV) matter. With a HELOC, CLTV is often the make-or-break number because it stacks on top of your first mortgage. With a cash-out refi, the new LTV is baked into the one loan.

Appraisal vs automated valuation (why it matters for speed + cost)

Valuation drives your LTV. And LTV drives approval, pricing, and how much cash you can access.

Some deals move fast with automated valuation. Others need a full appraisal. If you’re tight on LTV, the valuation method can decide the outcome. It can also decide your timeline and out-of-pocket cost.

Investment property and second-home nuance (if applicable)

Rules get stricter when the property isn’t your primary home. Pricing can be higher. Required equity can be higher too. That’s true for both sides of the cash out refinance vs heloc comparison.

“Primary residence” vs “investment property” rules (quick clarity)

Primary residence means you live there most of the year. Investment property usually means you don’t. If the lender classifies it differently than you expect, your rate, allowed cash-out, and approval odds can change.

Risks, gotchas, and myth-busting (save yourself from regret)

The cash out refinance vs heloc pros and cons debate gets noisy online. A lot of “advice” is really just people sharing what worked once. The safest approach is to understand the traps before you sign.

Myth: “I’ll just refinance the HELOC later”

Maybe. But you can’t assume it. Refinancing depends on rates, your income, your credit, and home value at that future moment. If any of those go the wrong way, your plan falls apart.

HELOC payment shock (draw ends, payment jumps)

During the draw period, you might only pay interest. That feels easy. Then the draw ends and the math changes. The payment can jump when principal repayment kicks in, especially with variable interest rates. People get caught because they budget for the low payment and ignore the later one.

Cash-out refi trap: raising the rate on your old balance

A cash-out refinance doesn’t just price the cash you want. It reprices your existing mortgage balance too. If your current rate is low, you may trade a cheap loan for an expensive one. That can cost more than the cash is worth.

Using home equity like a credit card (why that gets dangerous fast)

A HELOC is a revolving line. That makes it feel like a credit card backed by your house. The danger is behavioral. You draw, repay a little, then draw again.

Watch for fees, too. Some HELOCs have an annual fee, and some have early-close penalties. And if your line has a structure that ends in a large required payoff, it can act like a balloon payment problem when you least expect it.

Tax and deduction basics (home improvement vs other uses)

Tax rules can change, and deductions depend on your exact situation. So treat this as a high-level map, not personal tax advice. If you’re using a cash-out refinance or a HELOC to tap home equity, the key issue is usually what you used the money for, not just the interest rate.

When interest may be deductible (and when it usually isn’t)

In many cases, interest is more likely to be deductible when the loan is tied to your primary residence and the funds are used to buy, build, or substantially improve that home. If you used the cash for unrelated spending, like paying off consumer debt or covering day-to-day expenses, the interest often won’t qualify the same way.

Either way, you’re making interest payments on a mortgage-type debt. The IRS cares about purpose and documentation.

What records to keep (simple checklist)

- Closing documents for the cash-out refi or HELOC

- A clear paper trail showing where the money went

- Receipts and invoices for home improvement work

- Contractor agreements and permits (if applicable)

- A basic spreadsheet: date, amount, vendor, project, payment method

FAQs

Final decision checklist

You don’t need perfect predictions to make a smart choice. You need clean inputs, honest assumptions, and a plan for the worst-case payment. Here’s a quick checklist for cash out refinance vs heloc.

7-point checklist (your situation → best fit)

- Is your current mortgage interest rate “too good to touch”?

- Do you need one lump sum, or a flexible home equity line you can draw from?

- Can your budget handle the HELOC payment if rates rise?

- Are refinance closing costs worth it for your timeline?

- What do lenders require for your credit, income, and LTV/CLTV?

- Will you pay this off fast, or carry it for years?

- Which option keeps you disciplined with the debt?