Cash-Out Refinance Calculator

Model Payments, Interest, and Cash Flow

Why business owners use a cash-out refi to solve cash-flow problems

Cash flow can look “fine” on paper and still pinch in real life. One slow-paying client, a seasonal dip, or a surprise equipment repair can force you to choose between payroll, inventory, and keeping a cushion in the bank. If you’ve built equity in your home, a cash-out refinance is one way some business owners turn that locked-up value into usable cash.

The appeal is simple: you replace your current mortgage with a new loan for a higher amount, take the difference as cash, then repay it as part of your monthly payment. For the right borrower, that can mean consolidating higher-interest debt, funding inventory ahead of a busy season, or covering a short-term working-capital gap without stacking multiple payments across credit cards or short-term loans.

Still, the numbers matter. Interest rates, fees, and how much equity you’re leaving in the property can change the outcome quickly. That’s why this cash-out refinance calculator exists: to give you a fast reality check—estimated cash available, new payment, and basic limits—before you talk to a lender or start comparing refinance offers.

What a cash-out refinance actually is (and what it isn’t)

A cash-out refinance is a mortgage refinance where you replace your current home loan with a new mortgage that’s larger than what you still owe. The extra amount becomes cash you can use, while the full balance becomes your new loan amount. You’re not adding a second payment on top of your first mortgage. You’re swapping it out. That’s the big difference.

What it isn’t: it’s not “free money,” and it’s not a magic way to borrow without tradeoffs. The cash comes from the principal you’ve built in the property over time (your equity). Once you pull it out, you’re repaying it—with interest—over the new term.

The basic mechanics (new loan replaces current mortgage)

Think of it as three numbers: your home value, what you still owe, and how much you want back as cash. The refinance pays off your existing loan, then the new loan starts fresh with a new rate and term. That rate might be a fixed mortgage rate (stable payment) or an adjustable rate mortgage (payment can change).

Cash-out refinance vs HELOC vs personal loans (one-paragraph overview)

A cash-out refi folds your borrowing into one mortgage payment. A HELOC is a separate line tied to your home equity, usually with its own payment and often a variable rate. Personal loans are different because your house isn’t on the line. The tradeoff is cost and speed: the repayment window is usually shorter, and the interest rate is often higher than a mortgage. That combo can make the monthly payment feel heavy fast.

Common limits: LTV limits, loan-to-value ratio, loan-to-value limits

Most lenders also won’t let you refinance right up to your home’s full value. They use a loan-to-value (LTV) cap, which is just a way of saying, “You need to leave some equity in the property.” How much you can actually cash out comes down to that LTV limit, your credit and income picture, and whether the home is your primary place or an investment property.

FHA, VA, and conventional differences (high level)

Rules can shift by loan type and property. Homeowners refinancing a primary residence may see different limits than someone refinancing an investment property. Conventional, FHA, and VA programs also come with different guidelines around maximum LTV, fees, and underwriting.

Federal Housing Administration (FHA) and mortgage insurance

FHA cash-out refinancing can involve mortgage insurance, which changes the true monthly cost. That’s why it’s important to model both the payment and the all-in cost, not just the cash you receive.

Credit history + credit score expectations

Eligibility isn’t automatic. Lenders look at credit history, credit score, income, existing debt, and property. The calculator helps you estimate the math, but the final numbers come from underwriting and an appraisal.

How our cash-out refinance calculator works (inputs → results)

A cash-out refi sounds simple until you try to pin down the numbers. You’ve got home value, what you still owe on the current mortgage, closing costs, and the new rate and term. Change one input and the monthly mortgage payment can shift more than you’d expect. This cash-out refinance calculator is built to keep that math clear: you enter a handful of details, and it returns the key figures you’d typically sanity-check before talking to a lender.

Inputs you’ll enter (what they mean)

What each field affects before you calculate.

Home value

Used to calculate equity and loan-to-value limits.

Current mortgage balance

The remaining principal that must be paid off.

Interest rate + term

Controls payment size and total interest over time.

Closing costs

Rolled in or paid upfront, changing loan size.

Cash-out amount

Your target or the maximum allowed by LTV.

Outputs you’ll get (what to look at first)

The numbers lenders check immediately.

Maximum cash-out

Based on your value, balance, and LTV cap.

New loan + LTV

How leveraged the property becomes.

Monthly payment

Your new principal-and-interest obligation.

Cash received

Net cash after fees or rolled-in costs.

Step-by-step: use the calculator in 3 minutes

You don’t need to “know mortgages” to get value from this. You just need reasonable inputs. If you’re unsure on one field, use your best estimate, then rerun it with a second scenario. That’s how most borrowers compare options in a changing market.

Step-by-step: use the calculator in 3 minutes

Step 1 — Enter home value and current mortgage balance

Start with your home value and what you still owe on the current mortgage. Home value doesn’t need to be perfect, but don’t guess wildly. If you’ve checked recent local sales or a recent valuation, use that range and run two scenarios (low and high).

Step 2 — Choose refi rate and loan term (fixed vs adjustable)

Enter the rate you’re being quoted (or a conservative estimate) and pick a term. A fixed rate keeps the payment steadier. An adjustable rate mortgage can start lower, then shift later. The calculator doesn’t “recommend” either; it just shows the payment and total cost impact.

Step 3 — Add closing costs (and decide: roll in or pay upfront)

Add your expected closing costs. If you don’t have a quote yet, use a placeholder and update it later when you get lender estimates. Then choose how to handle the costs:

- Roll into the loan: larger balance, potentially higher payment, but less cash needed at closing

- Pay upfront: smaller loan, but less cash in hand after closing

Step 4 — Set cash-out amount (use “max” vs custom)

If your goal is a specific need (paying off debt, buying inventory, covering a tax bill), enter that cash-out amount. If you’re exploring your ceiling, use the max estimate, then work backward: “What happens if I take $20k less? Does the payment feel better?”

Step 5 — Read the results like a lender would (LTV + payment)

Two numbers matter right away:

- LTV: how much of the home’s value the new loan represents

- Payment: the monthly obligation you’re committing to

If either one looks tight, adjust the cash-out amount, term, or how you handle costs and rerun it.

Step 6 — Save/print/share your scenario (export options, if included)

Once you’ve got a scenario that feels realistic, save it. A simple summary (inputs + payment + cash received + LTV) makes lender conversations faster, and it helps you compare offers without mixing up numbers.

Feature walkthrough: what makes this calculator better than typical SERP tools

A lot of refinance calculators online are fine for a quick estimate, but they often hide the “why” behind the numbers. This one is built for decision-making. If you’re a business owner, you’re not just chasing the lowest payment. You’re trying to figure out how much cash is realistic, what it does to the mortgage, and what the costs look like over time.

Maximum cash-out based on loan-to-value limits

Instead of letting you type any number and hoping it makes sense, the calculator anchors your cash-out to loan-to-value limits. That keeps the scenario closer to what mortgage lending guidelines usually allow, so you’re not modeling a deal that dies at underwriting.

Closing costs modeling (roll into loan vs pay out-of-pocket)

Fees change the result in two different ways depending on how you handle them. Rolling costs into the new loan increases your balance (and usually the payment). Paying costs upfront can reduce the cash you actually walk away with. The calculator shows both paths so you don’t get surprised later when lender quotes arrive.

Payment math you can sanity-check (simple explanation of P&I)

The monthly payment is standard principal-and-interest math: loan amount, refinance rate, term. You shouldn’t need a black box to trust it. This tool keeps the inputs visible and the output straightforward, so borrowers can rerun scenarios and see what’s driving the change.

Break-even view (when refinancing costs pay back)

If you include current loan details, the calculator can show how long it takes for savings (if any) to offset closing costs. That’s useful when you’re weighing “lower rate” benefits against the real costs of the transaction.

Total cost snapshot (total interest vs payment comfort)

A lower monthly payment can come from stretching the term, which can increase total interest. This view helps you compare comfort today with total cost over the full timeline.

Amortization schedule preview (what happens month by month)

A quick month-by-month preview makes the loan feel real. You can see how much of each payment goes to interest early on and how the balance declines over time.

Rate sensitivity quick check (optional mini-scenarios)

Refinance rates move. A small bump can change the payment noticeably on a large loan amount. Rate sensitivity lets you see how fragile your plan is without rebuilding the whole scenario from scratch.

Mobile-first usability (fast inputs, clear results, no clutter)

Most borrowers run these numbers from a phone between meetings. The layout is designed for that: quick edits, readable results, and no tiny tables that break on mobile.

Real-world scenarios for business owners (with numbers you can relate to)

Numbers land better when they sound like real life. Below are four common ways business owners use cash-out refinancing. These aren’t “best case” examples. They’re meant to show the tradeoffs you’ll see when you plug your own inputs into the calculator: cash in hand, the new monthly payment, and what the loan term does to the total cost.

Scenario A—Consolidating high-interest credit cards into one mortgage payment

Let’s say you’re carrying $45,000 on credit cards from a slow quarter—ads, supplies, and a few months of payroll float. You refinance and take $45,000 cash out to wipe those balances. Your credit card payments might drop immediately because you’ve replaced several revolving minimums with one mortgage payment.

What changes: monthly payment vs total interest trade-off

Here’s the catch: rolling short-term debt into a long loan term can spread the cost out. Your monthly cash flow may improve, but the total interest cost can rise if you stretch repayment over decades. The calculator helps you see that clearly by showing both the payment and the total-interest snapshot. If the payment relief is the goal, that can still be a rational move. You just want to choose it on purpose.

Scenario B — Buying inventory or equipment without a short-term loan crunch

You’re heading into your busy season. You need $30,000 for inventory or a piece of equipment that pays for itself over time, but you don’t want a short-term lender setting your payment based on a 12–24 month schedule.

“Cash now” vs “cost over time” framing

Cash-out refinancing can turn that need into a predictable payment, but you’re still borrowing against your home. Use the calculator to run two versions: (1) the exact cash you need and (2) a smaller amount that still covers the essentials. Watch how the payment changes and how much the closing costs affect what you actually receive.

Scenario C — Renovating an occupied property (home improvements)

Some upgrades aren’t optional. A roof leak, HVAC failure, or a kitchen that’s been “temporary” for five years can start hurting your work-from-home setup or rental income.

Timing: draws vs lump sum (and why it matters)

A cash-out refi gives you a lump sum at closing. If your project will happen in phases, that lump sum can sit in your account while you’re paying interest on it through the mortgage payment. That’s where you compare it with a HELOC-style draw approach. Even without building a full HELOC model here, you can still use the calculator to test: “What if I only cash out what I’ll spend in the next 60 days?”

Scenario D — Funding a down payment on an investment property (caution + constraints)

You may be eyeing a small rental or a second location. Using home equity for a down payment can work, but it tightens the math fast.

Investment properties + occupancy rules (what to verify)

Property type matters. Occupancy rules, insurance costs, and lender guidelines can change what’s allowed and what it costs. Before you commit, run the numbers with a conservative rate and a realistic closing-cost estimate, and keep your monthly payment at a level your business can handle even in a softer month. The calculator gets you the baseline. A lender confirms the final limits.

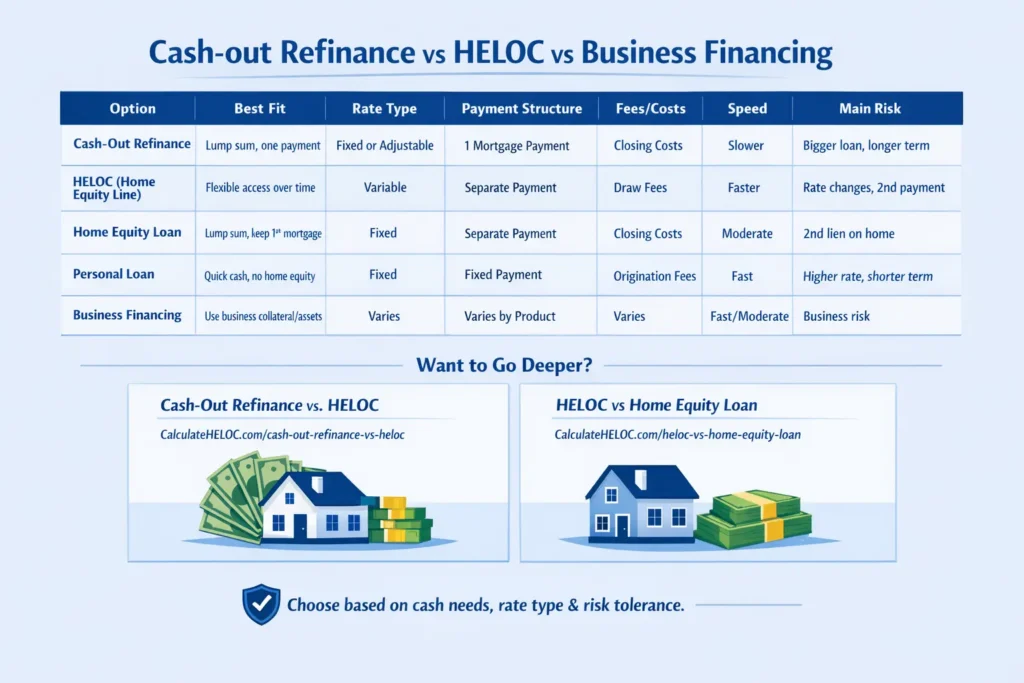

Cash-out refinance vs HELOC vs business financing (quick comparison table)

When you’re trying to get access to cash, the “best” option usually depends on two things: how long you need the money, and how stable you need the payment to be. A cash-out refi can simplify your life with one mortgage payment. A home equity line can be more flexible. Other financing options can be faster, but the standard repayment schedule may be tighter.

Comparison table: best fit, rate type, payment structure, fees, speed, risk

| Option | Best fit | Rate type | Payment structure | Typical fees/costs | Speed | Main risk |

|---|---|---|---|---|---|---|

Cash-out refinance One new mortgage replaces the old one. | You want a lump sum and one payment | Often fixed mortgage; sometimes adjustable rate mortgage | One monthly mortgage payment | Closing costs (lender + third-party) | Slower (full mortgage process) | Bigger loan on your home; restart/extend the term |

HELOC (home equity line) Draw funds as needed, repay over time. | You want flexible access over time | Often variable | Separate payment from first mortgage | Possible fees; interest on drawn balance | Often faster than refi | Payment can rise with rate changes; two payments |

Home equity loan One-time lump sum, second lien. | You want a lump sum without replacing your first mortgage | Often fixed | Separate fixed payment | Closing costs may apply | Mid-range | Two payments; lien on home |

Personal loan No home collateral; typically shorter term. | You need cash without using home equity | Often fixed | Fixed monthly payment (shorter term) | Origination may apply | Often faster | Higher payment pressure; higher rate |

Business financing Terms depend on product and underwriting. | You want financing tied to business cash flow/assets | Varies | Varies by product | Varies | Often fast to moderate | Business collateral/guarantees; repayment can be strict |

If you want a deeper breakdown with examples, use the comparison guide here: Cash-Out Refinance vs. HELOC: https://calculateheloc.com/cash-out-refinance-vs-heloc/

And for the “HELOC vs lump-sum” side, this one helps: HELOC vs Home Equity Loan: https://calculateheloc.com/heloc-vs-home-equity-loan/

When a HELOC can beat a cash-out refi (and when it usually doesn’t)

A HELOC can win when your spending happens in phases. If you’re renovating over six months or making periodic inventory buys, a home equity line lets you draw only what you need, which can reduce interest costs early on.

A cash-out refi tends to win when you want simplicity and stability: one payment, one schedule, and often the option of a fixed rate. It can also make sense when you’re replacing higher-cost debt and the new payment stays comfortable. The key is running both scenarios and looking at the total cost, not just the headline rate.

Costs, fees, and risks you should model before calling a lender

A cash-out refinance can be useful, but it’s still a mortgage. Before you get attached to a number, model the costs and the downside. Borrowers often focus on the cash-out amount and forget that fees, insurance, and a longer timeline can quietly change the real price.

Closing costs: what they typically include (origination, appraisal, title)

Most refinances include a mix of lender fees and third-party costs. You’ll commonly see items like origination or underwriting fees, an appraisal, title work, recording, and settlement/escrow charges. The exact list varies by lender and state, so treat the calculator’s closing costs field as your working estimate—then update it when you have a formal quote.

Mortgage insurance (when it shows up and why)

Mortgage insurance is the “cost of higher leverage.” If your new loan-to-value is above what the program allows without insurance, it can add a monthly charge (and sometimes upfront costs). Some programs (including certain FHA paths) handle this differently, so don’t assume the payment you see is the whole story unless you’ve confirmed insurance requirements for your loan type.

The “reset the clock” problem (term extension and long-run interest)

Refinancing can lower the monthly payment by stretching the loan term. That can help cash flow, but it can also increase total interest paid over time—even if the rate is decent. Run the calculator with two terms (like 15 vs 30 years) to see the tradeoff in black and white.

Foreclosure risk + cash-flow stress test (business downturn lens)

This is the part people skip: your home is collateral. If the business hits a rough patch and income drops, the mortgage payment doesn’t care. Stress test it. Ask, “If revenue falls for three months, can I still make this payment and keep insurance and taxes current?” If the answer is shaky, reduce the cash-out amount or consider options with less long-term commitment.

Tax notes (high level only; advise CPA)

Tax rules can be fact-specific. Some costs may be deductible in certain situations, and the use of funds can matter. Don’t rely on a generic rule-of-thumb—run your numbers in the calculator for planning, then confirm the tax impact with your CPA based on your exact situation.

Quick eligibility checklist (so your numbers match reality)

A calculator can show what’s possible on paper. Lenders decide what’s possible in the real world. Before you assume the result is “your deal,” run through this quick checklist. It keeps your expectations grounded and saves time when you start comparing offers.

Credit + debt-to-income basics (what lenders look at)

Your credit score and credit history affect both approval and pricing. Lenders also look at income stability and how your monthly debts stack up against that income (debt-to-income). If you’re carrying large card balances, recent late payments, or uneven business income, the rate and the maximum cash-out can look different than your first scenario. The fix is simple: rerun the calculator with a slightly higher rate and a smaller cash-out amount so you’re not planning on a best-case quote.

Appraisal and property type (occupied properties vs investment property)

The appraisal matters because it sets the value used for your loan-to-value ratio. Property type matters because guidelines can tighten for an investment property compared with an owner-occupied home. If you’re refinancing a rental, don’t use optimistic assumptions. Use a conservative home value and be cautious on how much cash-out you expect.

FHA vs conventional vs VA: what can change in your result assumptions

Loan programs can change the rules around maximum LTV, required mortgage insurance, and how the loan is priced. An FHA loan can bring different insurance costs. Conventional pricing can shift based on credit and LTV. VA loans have their own guidelines. The calculator gives you a clean estimate; the right next step is choosing the program you’re actually eligible for, then updating the inputs to match the lender’s quote and limits.

FAQs about using a cash-out refinance calculator

Next steps: run your numbers, compare options, then talk to a lender

Once you’ve run a few scenarios, you’ll have something most borrowers don’t: a clear baseline. In a moving market, “rates today” can change the payment enough to flip a decision, so keep it simple. Model one conservative case, one realistic case, and one stretch case. Then compare.

Use the calculator (plus a short checklist of what to gather)

Before you reach out to lenders, gather a few basics so your refinance calculator results stay close to reality:

- Estimated home value (use a range if you’re unsure)

- Current mortgage balance and current rate

- A rough idea of closing costs (update once you get quotes)

- Your target cash-out amount and what it’s for

- Your comfort level for the monthly payment

Run the numbers, adjust, and save the scenario that fits your cash flow without feeling tight.