HELOC vs Home Equity Loan: Key Differences, Pros & Cons for Homeowners

Quick Summary: Which One Fits Your Situation?

If you need about $30,000 for a renovation and you are weighing HELOC vs home equity loan, start with the key differences. A home equity line of credit gives you a revolving limit you can draw from during a draw period, often with a variable interest rate and the option for interest-only monthly payments. A home equity loan gives you a lump sum at closing, a fixed interest rate, and a predictable payment from day one. In plain terms, choose flexibility and pay interest on only what you use, or choose certainty and lock in a fixed plan with your lender.

Best fit at a glance

- Choose a HELOC if costs are uncertain, the project will happen in phases, or you expect to repay quickly. You borrow as needed and can keep monthly payments low during the draw period, but the rate can change.

- Choose a home equity loan if you know the exact budget or want full payment predictability. You get the funds upfront and lock in a fixed interest rate, but you pay interest on the entire amount.

Mini pros and cons

- HELOC pros: flexible access, interest on what you use, reusable line.

HELOC cons: variable interest rate, possible payment increases after the draw period. - Home equity loan pros: fixed interest rate, steady monthly payments, simple plan.

Home equity loan cons: less flexible, interest accrues on the whole lump sum.

Three-step Chooser

- Define the need: fixed budget or moving target.

- Decide the priority: flexibility and lower initial payments, or rate and payment certainty.

- Stress-test payments: compare a variable HELOC scenario with a fixed loan plan.

Next step: Run your numbers in our HELOC calculator to see how monthly payments differ between a home equity line of credit and a home equity loan, then adjust for rate changes and payoff speed:

What Is a HELOC? How It Works (Draw Period → Repayment)

A HELOC is a home equity line that gives you a reusable line of credit secured by your home. Your lender approves a credit limit based on your equity, income, and credit score. You access money as needed, repay, then draw again within set rules. Think of it like a credit card backed by your house, with rates that usually move over time.

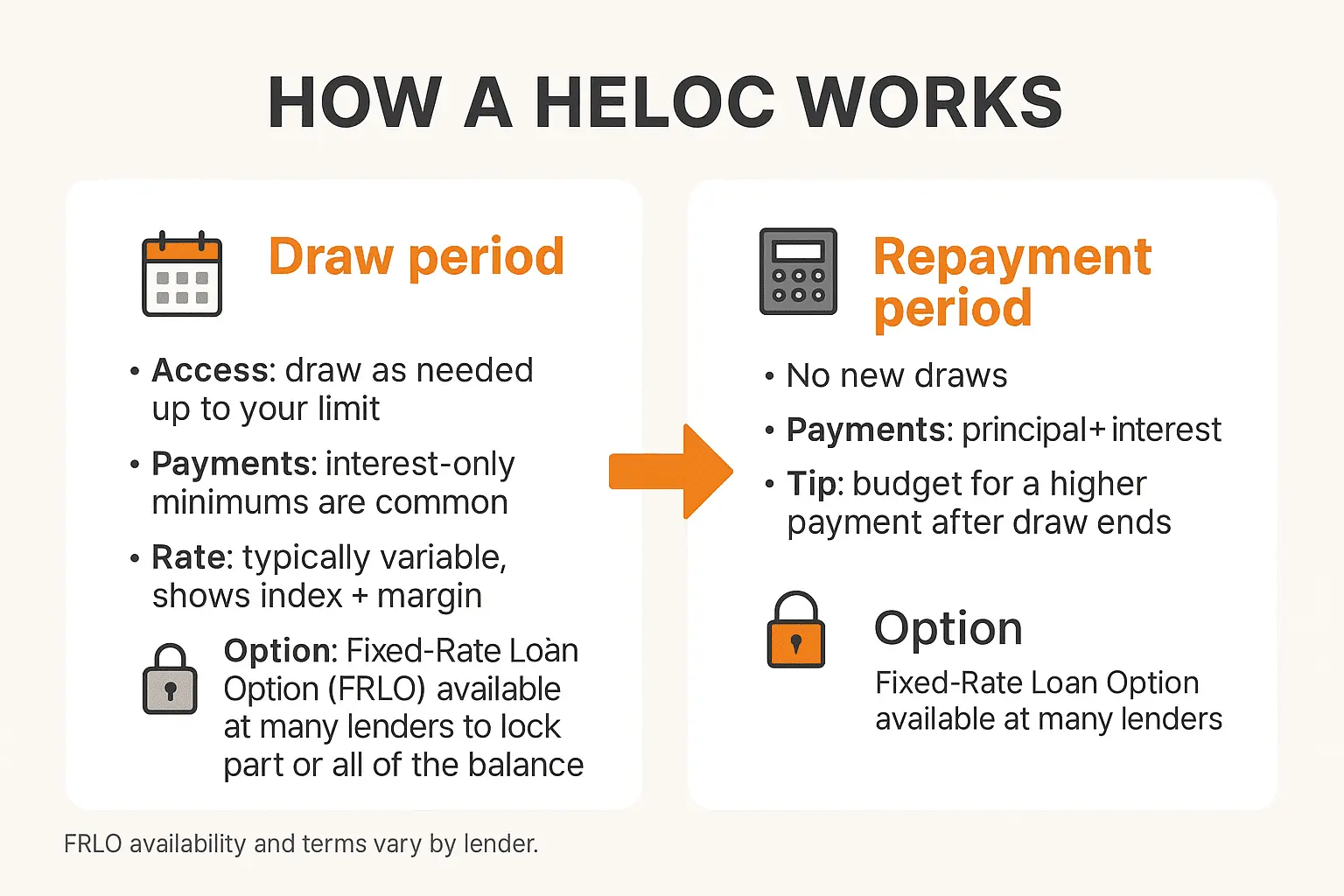

How the draw period works

During the draw period, you can request advances up to your limit for projects, emergencies, or cash-flow gaps. The account typically carries a variable interest rate, so the interest rate can shift as market conditions change. Minimum payments in this phase are often interest-only, which keeps the bill low while you are spending on the project. You can pay extra toward principal at any time to free up available credit.

How the repayment period works

When the draw window ends, the HELOC transitions to the repayment period. New draws stop. Your remaining balance is amortized, so the payment now includes principal and interest. Because the variable interest rate can change and you are no longer interest-only, your required payments may rise compared with the draw years. Paying down principal faster can reduce total interest and shorten the schedule.

Rate mechanics and fees

A HELOC rate is usually an index chosen by the lender plus a margin, which is why it varies. A stronger credit score and a lower loan-to-value ratio can help you qualify for a better margin. Expect standard costs such as appraisal, possible annual fees, or early closure fees, depending on the provider.

Fixed-Rate Loan Option (FRLO)

While HELOC rates are typically variable, many lenders let you lock the rate on some or all of your balance. The locked portion turns into a fixed sub-loan with a set term and steady payment. Your remaining line stays open and variable for future draws. This gives you the flexibility of a line with the security of a fixed rate where you want it.

What Is a Home Equity Loan? Lump Sum, Fixed Rate, Fixed Payment

A home equity loan is a secured installment loan that provides a lump sum at closing. You lock a fixed interest rate, then repay the balance with equal monthly payments for a set term. Because the rate and payment are fixed, budgeting is straightforward from the first bill to the last.

How the money and payment work

At funding, the full amount is disbursed to you. Your payment is amortized, which means each bill includes principal and interest payments according to a schedule. Interest is calculated on the entire outstanding balance, not just what you spend. For example, a $30,000 loan at 8% for 10 years produces a monthly payment of about $364, and total interest around $13,678 over the term. You can pay extra toward principal to reduce interest and finish sooner, but your required payment does not change unless you refinance.

Rate, term, and common costs

The fixed interest rate stays the same for the life of the loan, which shields you from rate swings. Terms vary by lender, often in multi-year options such as 5, 10, 15, or 20 years. Closing costs may apply, similar to a smaller mortgage, and can include appraisal, title, recording, and an origination fee. Some lenders allow you to roll costs into the loan; others prefer you pay at closing. Read the note and fee schedule so you know exactly what you will owe and when.

When a home equity loan fits best

Choose a home equity loan when you have a defined budget, want a single disbursement, and prefer a payoff plan that never changes. It is well suited to one large project or debt consolidation where a fixed timeline is part of the goal. If your costs are likely to change or occur in stages, a HELOC may offer better flexibility, since it lets you draw as needed during its draw period and manage spending in phases.

HELOC vs Home Equity Loan: Side-by-Side Comparison

Use this quick chart to compare key differences so you can match the product to your project and budget style.

| Category | HELOC | Home Equity Loan |

|---|---|---|

| Access to funds | Reusable line of credit you draw from as needed during a set draw period | One-time lump sum disbursed at closing |

| Interest rate | Typically variable interest rate (index + margin set by the lender) | Fixed rate for the entire term |

| Payment structure | Often interest-only during the draw period; then principal + interest in repayment | Level monthly payments with amortization from day one |

| Timeline | Two stages: draw period, then repayment period with no new draws | Single stage: fixed term from start to finish |

| Fees | May include annual fee, transaction limits, or early closure fee; standard closing fees vary by lender | Closing costs similar to a small mortgage; some lenders allow costs to be financed |

| Flexibility | High. Borrow only what you need and prepay to free up credit | Lower. Amount and schedule are set at origination |

| Typical uses | Projects in phases, evolving budgets, emergency access, bridging cash flow | Defined-budget remodels, debt consolidation, single large expense with a firm payoff plan |

| Payment risk | Payment can rise if the interest rate adjusts; higher required payment after the draw period ends | Payment stays the same; less risk of payment changes but interest accrues on the full principal |

| Best for | Borrowers who value flexibility and can handle rate movement | Borrowers who want predictability and a fixed payoff schedule |

Takeaway: If you want on-demand access and lower initial payments, a HELOC leans flexible but rate sensitive. If you want certainty, a home equity loan locks the interest rate and the budget from the start.

When to Choose a HELOC (Best-Fit Scenarios)

A HELOC, or home equity line of credit, shines when your costs move around and you want control over timing. You open a credit line, then draw as needed during the draw period, so your interest payments apply only to the money you actually use. If that matches your financial situation, a HELOC can be the right choice.

Great fits for a HELOC

- Phased renovations. Kitchen now, flooring later, landscaping at the end. You can stage borrowing to match invoices instead of taking a lump sum on day one. Paying interest only on draws keeps cash flow smoother while the work unfolds.

- Uncertain project scope. If a remodel might change after demo day, a line lets you adjust without refinancing or reapplying. You avoid paying interest on dollars you never needed.

- Short payoff plans. Expect a bonus, tax refund, or sale proceeds within a year or two. Use the line now, then wipe the balance quickly to reduce total interest.

- Emergency access. Treat the line like a safety valve for medical bills or urgent repairs. You are not charged interest until you tap it.

- Irregular income. For commission or seasonal earnings, interest-only minimums during the draw period can help you bridge slow months, then you can prepay principal when income spikes.

Smart discipline tips

- Set a project cap. Decide a maximum draw per phase and track it weekly.

- Automate extra principal. Add a small principal add-on to each payment so the balance falls faster.

- Create a pay-down date. Tie it to a known cash event and schedule transfers in advance.

- Ask about options. Some lenders allow part of the balance to be converted to a fixed sub-loan. If available, this can add predictability mid-project.

- Keep headroom. Avoid maxing the line. Leaving room protects you from surprises and reduces stress if rates move.

If you prefer a single disbursement, a fixed rate, and the same monthly payments from day one, the home equity loan section is the better match.

When to Choose a Home Equity Loan (Best-Fit Scenarios)

A home equity loan suits plans with a clear price tag and a schedule you do not want to change. You receive a lump sum, lock a fixed interest rate, and follow fixed payments that never surprise you. Because the loan is fully amortization based, every payment reduces principal on a predictable path.

Strong use cases

- One-time projects with firm bids. A roof replacement, a solar install, or a full bathroom remodel that has a signed estimate fits neatly into a single disbursement. You fund the work at closing, then focus on payoff rather than juggling draws or phases.

- Debt consolidation with a target end date. If you want to replace several high-rate cards with one schedule, a home equity loan keeps the plan on rails. Level payments help you avoid creeping balances, and the calendar gives you a finish line for the payoff.

- Budget certainty in a rate-sensitive market. If your priority is stability, a fixed interest rate and even monthly payments remove variability. You can line up the payment with payday and keep the rest of the budget unchanged.

- Long-term payoff goals. For upgrades that pay you back slowly, such as energy improvements or an accessory dwelling unit, a fixed term provides the runway you need. You can still add extra principal to finish early, but you are never required to chase rate changes.

How to confirm it fits

- Price the project fully. Compare quotes and include permits, contingencies, and taxes so the lump sum matches reality.

- Test affordability. Use the calculator to model the payment at your term, then add a small buffer for comfort.

- Check the timeline. Pick a term that aligns with your goals, for example, before kids start college or before retirement.

What to watch

- You pay interest on the entire outstanding balance, not just what you use.

- If the scope might expand later, consider a small contingency in the loan amount or compare with a HELOC for flexibility.

If your costs are fixed and your priority is a steady payoff, the home equity loan is often the right tool for the job.

Pros and Cons: HELOC

A HELOC gives you flexible access to your home’s equity, but that flexibility comes with tradeoffs. Use this quick list to weigh the pros and cons for your budget and timeline.

Pros

Pay interest on what you use. You draw only when needed, so payments reflect the balance you actually borrow.

Flexible cash flow during the draw period. Many lines allow interest-only minimums in the early years, which can keep the bill manageable while a project is in motion.

Reusable credit. As you repay principal, the available credit opens back up, which is handy for phased renovations or surprise costs.

Potential to prepay without penalty. Many lenders allow extra principal at any time, so you can shorten repayment and reduce total interest.

Option to fix part of the balance. Some institutions offer a fixed-rate “segment” or convert portion, adding stability on a chunk you plan to carry longer.

Cons

Rate movement risk. Most HELOCs carry a variable interest rate, so your cost can rise with the index and margin. If rates climb, the bill can climb too.

Payment shock at the end of the draw. When interest-only ends, required payments switch to principal plus interest. Budget for a higher number once the repayment period begins.

Overspending risk. Easy access to funds can tempt larger draws than planned. Without a cap and a schedule, balances linger and interest adds up.

Possible line freeze or reduction. A lender may adjust or suspend a line after a credit review or a change in property value. Keeping strong credit, stable income, and reasonable utilization helps reduce this risk.

Fees and conditions. Annual fees, minimum draw rules, or early closure charges can apply. Read the agreement so you know how activity is measured.

Collateral at stake. The line is secured by your home. Missed payments can trigger serious consequences.

Bottom line: A HELOC works best when you want control over timing and plan to repay quickly. If you prefer a single check and steady fixed payments, a home equity loan may fit better.

Pros and Cons: Home Equity Loan

A home equity loan gives you a lump sum, a fixed rate, and level monthly payments for the full term. The plan is simple. You borrow once, then follow a set repayment schedule where each payment reduces principal.

Pros

Predictable budget. A fixed rate and equal monthly payments make planning easy. You know the amount due and the payoff date from the start.

Disciplined payoff. Amortized repayment means every payment chips away at principal, helping you stay on track.

Often lower than unsecured rates. Compared with personal loans or credit cards, the fixed rate on a secured loan is commonly more favorable.

One-time funding for a defined project. A single disbursement matches firm bids and avoids the temptation to keep drawing more.

Clear timeline options. Terms like 5, 10, 15, or 20 years let you balance payment size and total interest.

Potential relationship perks. Some lenders may offer small rate discounts for autopay or qualifying account relationships.

Cons

Less flexibility. Once funded, the amount and schedule are set. If the project grows, you need a new application or a separate line.

Interest on the full balance. You start paying interest on the entire lump sum from day one, even if part of the money sits unused briefly.

Upfront costs and time to close. Appraisal, title, and other closing costs can apply, and the process can take longer than a simple credit line.

Early payoff considerations. While many loans have no penalty, some lenders recapture closing cost credits if you close or refinance very early. Read the note.

Budget miss risk. Borrow too much and you pay interest you did not need. Borrow too little and you could face a second loan or change orders.

Collateral risk. The loan is secured by your home, so missed payments carry serious consequences.

Bottom line: Choose a home equity loan when you want a fixed rate, steady monthly payments, and a clean path to zero. If costs arrive in stages or may change, compare with a HELOC for flexibility.

Costs, Rates & Fees in 2025: What to Expect & How to Shop

Costs, Rates & Fees in 2025: What to Expect & How to Shop

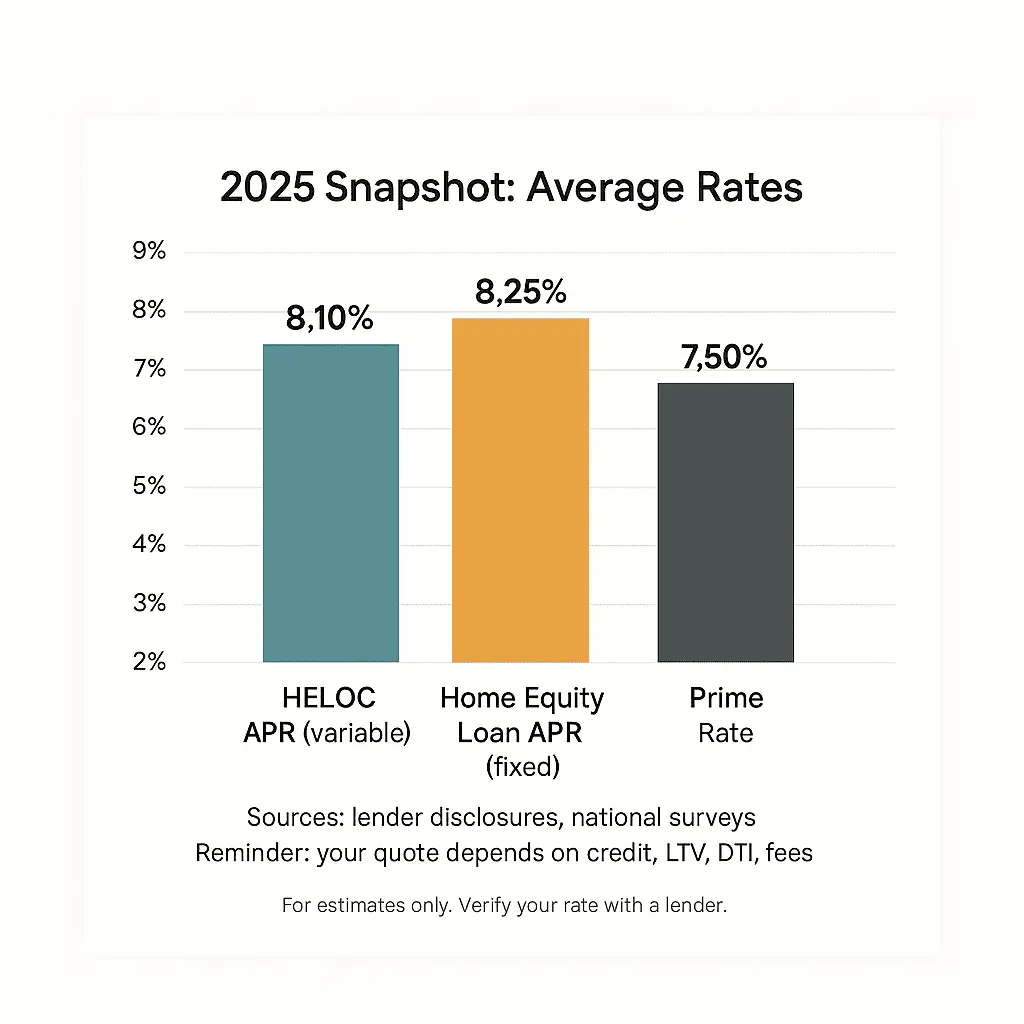

Here’s a grounded snapshot for late-2025. Average HELOC APRs are sitting around 7.8%, and home equity loan averages are near 8.0%, based on national surveys of major lenders. Use these as ballpark markers, then price your own quote. (Bankrate)

How pricing works

- Variable vs fixed. Most HELOCs track an index plus a margin. Many banks reference the Wall Street Journal Prime Rate; for context, Prime was 7.00% on October 31, 2025, and your APR adds a lender margin on top. Home equity loans lock a fixed rate for the full term. (Chase)

- Intro offers. Some HELOCs start with a discounted teaser APR for a few months, then reset to index + margin. Regulators require lenders to disclose that the initial APR is a discount and how and when it will adjust. (Consumer Financial Protection Bureau)

Common fees to watch

- Opening costs. You may see appraisal, title, origination, and recording charges. (Consumer Financial Protection Bureau)

- Annual or inactivity fees (HELOCs). Lines can include yearly membership fees, inactivity fees, early closure fees, or conversion fees if you fix part of the balance. Read the fee schedule before you sign. (Consumer Financial Protection Bureau)

When fixed beats variable

- If you want payment certainty for a single, defined project, a fixed-rate home equity loan often wins.

- If you need phased spending and plan to repay quickly, HELOC can start cheaper, but budget for adjustments if rates change.

Smart shopping game plan

- Collect 3 quotes from a bank, a credit union, and an online lender. Ask for the index, margin, all fees, and any intro terms so you can truly compare lenders.

- Stress-test payments. Model a HELOC at today’s rate and at +1–2 percentage points to see how your monthly budget holds up.

- Use a reference point. Check public averages to sanity-check your quote; Bankrate’s national snapshots are useful context, not targets.

- Pick the fit. Choose variable for flexibility, fixed for stability. If your lender offers a HELOC “fix-a-segment” option, you can blend both.

Try it now: Plug your numbers into the calculator and test a base case vs a rate-shock scenario: HELOC calculator.

Closing Costs and Fees: What to Expect

Both HELOCs and home equity loans are secured by your home and usually include closing costs of about 2%–5% of the amount. Typical items include appraisal, title, origination, recording, and sometimes an annual HELOC fee. Some lenders offer no-closing-cost options. You usually accept a slightly higher interest rate or agree to keep the account open for a set period. Read the fee schedule so you know how and when charges apply.

Eligibility & How Lenders Decide: Credit Score, LTV, DTI, Equity

Lenders approve a home equity loan or line of credit by weighing your credit score, available equity, loan-to-value math, and your ability to handle more debt. The process is called underwriting. Here is what usually matters and how to put your best foot forward.

Core approval factors

- Equity and LTV. The combined loan-to-value is calculated as: existing mortgage balance plus the new amount, divided by the home’s appraised value. Many programs cap CLTV around 80 to 85 percent. A lower ratio often earns better pricing.

- Credit score. Many lenders look for at least the mid-600s to approve, while scores in the 700s and above tend to qualify for stronger terms. On-time histories and low revolving balances help.

- Debt-to-income (DTI). Underwriters add up your monthly debts and divide by gross income. Programs often aim for totals near the low-40s, though guidelines vary by lender and file strength.

- Income and employment. Expect verification with W-2s, recent pay stubs, and possibly tax returns if self-employed. Stability and consistent hours support approval.

- Property and occupancy. Primary homes get the broadest access and pricing. Second, homes and investment properties may have tighter limits.

- HELOC vs loan qualifying. For a HELOC, lenders qualify you using a calculated payment on the requested line of credit at a fully indexed interest rate with program assumptions. For a fixed home equity loan, they use the actual amortized payment.

Documents you may be asked for

- Government ID, homeowner’s insurance, recent mortgage statement

- W-2s or 1099s, pay stubs, two years of tax returns if self-employed

- Bank statements to verify reserves and closing funds

Ways to improve approval odds

- Trim card balances to lift your credit score and lower DTI.

- Request only the amount you need to reduce CLTV.

- Pick a term where the proposed payments fit your budget test.

- Fix credit report errors and set accounts to autopay before you apply.

- Prepare the home for appraisal and gather documents early to avoid delays.

If approval is tight, compare a smaller request, a longer term, or wait a month after lowering balances. Then shop more than one lender so you can compare guidelines and pricing side by side.

Borrower Qualification Requirements

Equity and LTV. Plan on at least 15%–20% equity remaining after you borrow. Many programs cap combined LTV at 80%–85%.

Credit score. Minimums often fall in the 620–680 range. Scores of 700+ usually get better pricing.

DTI ratio. Many lenders aim for a 43% max on total debt-to-income. Some allow up to 50% with strong files.

Docs. Expect ID, income verification, insurance, recent mortgage statement, and bank statements.

How to Choose: A Simple Step-by-Step Framework

Use these decision steps to find the right choice for your financial needs. Keep it simple, compare both paths, then pick the plan you can live with month after month.

Step 1. Define the project and timing

Is the price fixed or fuzzy? If the budget is locked and paid all at once, a home equity loan fits neatly. If costs arrive in stages or may change after work starts, a HELOC gives you room to adjust.

Step 2. Pick your priority

Ask yourself which matters more: fixed payments you can set on autopay, or on-demand access with a variable interest rate. If predictability wins, lean loan. If flexibility wins, lean HELOC.

Step 3. Size the amount with a cushion

Total the project cost, add a small contingency, then check your equity and comfort level. Do not borrow more than you can repay while keeping savings intact.

Step 4. Model a HELOC scenario

Open the HELOC calculator and enter:

- Project amount you expect to draw.

- Starting APR and the draw period length.

- A payoff plan during and after the draw.

Review the output for required payments during the draw and the larger payment in the repayment period.

Step 5. Stress-test the HELOC

Increase the APR by +2% and again by +1%. This shows how a variable rate could change your bill. If the higher payment breaks your budget, note that risk.

Step 6. Compare a fixed loan payment

Get a fixed interest rate quote and term from a lender or use a basic amortization calculator. Record the single, level payment and total interest. This is your certainty benchmark.

Step 7. Choose and prepare

- Pick HELOC if you value flexibility, can handle rate movement, and plan to prepay principal as cash comes in.

- Pick home equity loan if you want a set payment and a clear finish line.

Before you apply, clean up card balances, set bills to autopay, and gather income documents. Better inputs help you qualify and may improve pricing.

Result: a practical, side-by-side view that shows which option fits your project, your cash flow, and your comfort with rate changes.

Real-World Examples & Calculator Walkthrough

Below are two clean, number-driven illustrations. Use them to sanity-check your plan, then plug your own figures into the calculator.

Example 1: $30,000 phased remodel with a HELOC

Assume a variable interest rate of 7.99% and a 24-month draw period with three draws: $12,000 in month 1, $10,000 in month 6, and $8,000 in month 12.

- Interest-only path during draw: interest payments step up as the balance grows. Month 1 is about $79.90 on $12,000, month 6 after the second draw is about $146.48 on $22,000, and after the third draw, a fully drawn $30,000 is about $199.75 per month. Total interest during the draw is roughly $3,875.

- Repayment period, base rate: at month 25 the balance is $30,000. Amortized over 10 years at 7.99%, the monthly payment is about $363.82, and interest over the repayment period is about $13,659.

- Total interest, base case: about $17,534.

- Accelerated payoff during draw: add $300 extra principal each month in the draw period. The balance falls to about $22,800 by month 25. A 10-year repayment at 7.99% is about $276.51 per month and $10,381 interest. With the draw-period interest (about $3,324) the total interest drops to about $13,705.

- Stress test: if the repayment APR were 2 points higher, a $30,000 balance over 10 years at 9.99% would pay about $396.29 monthly and $17,554 interest in repayment, lifting the HELOC total interest to about $21,429.

Example 2: $30,000 lump sum with a home equity loan

Assume a fixed interest rate of 8.25% for 10 years. The monthly payment is about $367.96. Total interest payments over the term are about $14,155. Payments are level and reduce principal each month.

Try it yourself: Enter your project amount, rate, and term, then compare the two paths side by side. In the HELOC view, model phased draws and tests rate increases of 1 to 2 percentage points to see how the repayment period changes. In the fixed-loan view, adjust the term to match your budget.

Calculator CTA: Run the numbers on our HELOC calculator.

Risks, Protections & Tax Notes

Using home equity can be smart, but there is risk. These loans are secured by your house. If payments are missed, a lender can pursue foreclosure after required notices and timelines. Always size the amount so you can pay through slow months, not just good ones.

Rates matter. A HELOC usually carries a variable interest rate, so your cost can rise if the index moves. That can lift both your minimum during the draw and your required payment in the repayment period. Ask for the index and margin, the adjustment frequency, and any caps. For a fixed home-equity loan, the rate stays put, but you still owe on the whole balance from day one.

Lines can change. In certain conditions a lender may reduce or freeze a HELOC. Common triggers include a drop in property value, a material change in credit, or new information about income. Keep utilization reasonable, protect your credit score, and monitor home value trends to lower this risk.

Refinancing is not guaranteed. If you plan to refinance later, remember that approval depends on market rates, your credit, income, and home value at that time. If any of those weaken, refinancing may cost more or may not be available.

Insurance and reserves help. Maintain homeowners’ insurance and consider an emergency fund equal to a few payments. If you run close to the loan-to-value limit, small price declines can tighten future options.

Tax note: Interest on home equity borrowing is only potentially deductible when the funds are used to buy, build, or substantially improve the home that secures the loan, and only within IRS limits. Keep invoices and a clear paper trail that ties draws to qualified work. This is general information, not tax advice.

Before you sign, review the note, fee schedule, and adjustment terms with the lender. Run worst-case payment scenarios in the calculator so you know the budget impact if rates rise.

Alternatives to Consider (And When They Make Sense)

Cash-out refinance (refi). Roll equity into a new first mortgage. Pick this when your current rate is close to today’s market or your adjustable-rate mortgage will reset soon. You get one fixed payment and a long term. The tradeoff is losing a low existing rate and paying full refinance closing costs.

Personal loans. These are unsecured debt with fixed terms and quick funding. They fit smaller projects or debt cleanups when you do not want to pledge the house. Rates are usually higher than secured options and loan sizes are smaller, so compare carefully.

0% intro APR credit card. Useful for tightly scoped purchases you can pay off fast. The benefit is interest-free months during the promo. Watch for balance transfer fees and the go-to APR after the intro period. Only use this if you can clear the balance before the deadline.

Renovation loans. Programs like FHA 203(k) or Fannie Mae HomeStyle wrap project costs into a mortgage. Good when the property needs major work and you want a single fixed payment. Expect more paperwork, inspections, and, for some options, mortgage insurance.

Contractor or retail financing. Often convenient at the point of sale with deferred interest or short promos. Read the fine print. If the promo expires with a balance, the back-dated interest can erase the savings.

Using savings. Paying cash avoids interest altogether. Keep a cushion for emergencies, then fund part of the project from reserves to shrink what you need to borrow.

If you are hanging on to a very low first-mortgage rate, starting with smaller, fixed-term personal loans or a short 0% window on a credit card may be cheaper than a full refinancing. Run the numbers side by side so the total cost and payoff timeline are crystal clear.