Business Line of Credit Calculator

Model Payments, Interest, and Cash Flow

What is a Business Line of Credit Calculator?

A business line of credit (LOC) is revolving credit. You draw when you need cash. You repay, then draw again. Many LOCs price at index + margin (for example, a prime-based index). Fees may apply at origination, per draw, monthly, or yearly.

The business line of credit calculator turns those moving parts into a plan. Enter your limit, draw schedule, rate model, fees, and payment policy. The tool projects payments, interest, fees, and balances across months. You’ll see:

It’s a planning tool you control. Use it before you accept terms, or to manage an active line.

How a Business Line of Credit Works

Revolving

repaid principal becomes available again

Variable rates

index + margin

Event-based

draws and repayments land on set dates

Accrual

End-of-period or average daily balance (ADB)

When to Use a Business LOC vs a Term Loan or HELOC

Business LOC

Short-term needs—inventory buys, payroll timing, receivable gaps.

Term Loan

Fixed assets with long life.

HELOC

Home-equity product; not optimized for business metrics.

Why Use a Business Line of Credit Calculator for Planning?

Irregular draws

Add multiple events by amount. See how timing changes interest and payments.

Rate clarity

Model index + margin. Test a future increase or decrease. Know the impact before you sign.

Fee transparency

Turn origination, per-draw, inactivity, monthly, and annual fees into dollars on a timeline. No surprises.

Cash-flow alignment

Pick a payment policy—interest-only, a percent of balance with a $ floor, an interest+principal floor, or weekly installments.

How to Use the Business Line of Credit Calculator

Follow these steps. It takes minutes.

Enter credit limit, and your draw plan

Set credit limit and current balance. Choose a cycle count (e.g., 24 months). Add Draw and Repayment terms. Use patterns for seasonal builds or a simple payroll bridge.

Set your rate model: Index + Margin

Pick base days (365 or 360). Enter the index and margin; the combined APR updates. Add an index schedule to simulate future changes, then compare scenarios like Base, +1%, +2%, or −1%.

Add fees and choose a payment policy

Configure annual, per-draw, inactivity, and monthly maintenance fees. Choose how you want to pay:

- Interest-only

- Percent of statement balance with a dollar floor

- Interest + principal floor

- Weekly installment (split the required cycle amount into four weekly payments during the cycle)

Weekly payments often reduce interest because the balance falls earlier in the month.

Click Calculate

The engine builds a daily ledger and cycle summaries. You’ll see the next payment, this cycle’s interest, the peak payment across 12 cycles, and months to zero if applicable. Charts show balance over time and payment composition (interest, principal, fees).

Export or share

Export per-cycle schedules (CSV/XLSX).

Inside the Calculator: Advanced Features

Two-Phase Simulation

Model both the draw period and the repayment period for clarity across the full lifecycle.

Draw Schedule Presets

Speed setup with 24-months presets: Ad-hoc, Upfront Inventory, Seasonal Business, Payroll Bridge—all editable.

Prime + Margin with APR Display

Set prime and margin; see total APR. Adjust base to match your agreement.

Business Payment Policies

Pick interest-only or a percentage of balance with an interest floor. Switch to weekly installments to lower average daily balance.

Scenario Comparison (A/B)

Clone your setup, tweak inputs, and compare total interest, total fees, peak payment, and effective APR with color cues.

Results, Charts, and Schedules

See Peak Balance, Term Payment, Effective APR, Total Interest, Total Repayment, an interactive chart, and a detailed amortization table.

Example Walkthroughs

Example A — Seasonal draw with weekly repayments

- Limit: $50,000

- Draw: $20,000 on day 1

- APR: index 7.25% + margin 2.5% = 9.75%

- Base: Upfront inventory

- Policy: Monthly installment

A flat $20,000 for 36 at 9.75% is about $163/month in interest. Split the cycle payment into four weekly amounts and interest drops because the balance falls earlier.

Example B — Margin and fees change total cost

Two offers at the same index:

- Offer 1: margin 2.5%, 1% per-draw fee

- Offer 2: margin 4.0%, 0% per-draw fee

If you draw often, per-draw fees add up. If you carry a balance longer, the higher margin hurts more. Run both in the scenario table and compare total interest, total fees, and peak payment.

Frequently Asked Questions

Methodology: How the Business LOC Works

This business loc calculator models a credit line in two phases, then rolls everything into clear payments, interest, fees, and totals. It runs on a periodic schedule you choose—monthly or weekly.

1) Two-Phase Structure

Draw Period — fixed at 24 months

- You can draw up to your credit limit using the monthly draw schedule you provide.

- You must make minimum payments during this phase based on your selected policy.

- New draws stop at the end of month 24.

Repayment Period — variable term

- Any remaining balance converts to a standard amortizing loan.

- No further draws are allowed.

- You choose the Repayment Term (months). The fixed payment pays the balance off by that term.

2) Calculation Engine (period-by-period)

For each period (month or week), the engine performs these steps in order:

A. Apply periodic fees

- Annual fee ($): charged in the first period of each year.

- Monthly maintenance fee ($): charged in the first period of each month.

B. Process draws (Draw Period only)

- Add your scheduled draw to the balance.

- The draw is capped by available credit (Limit − Current Balance).

- If a draw occurs, the tool applies Draw Fee (%) and Per-Draw Fee ($).

- If no draw occurs this period, apply the Inactivity Fee ($).

C. Calculate period interest

- Interest = Outstanding Balance × (Total APR / Periods-Per-Year)

- Use 12 for monthly; 52 for weekly.

D. Determine the payment (per policy)

- During the 24-month Draw Period

- Interest-Only: Payment = period interest. No principal reduction.

- % of Balance: Payment = chosen % × outstanding balance. The tool ensures it at least covers interest.

- Interest + Principal Floor: Payment = period interest + your fixed Principal Floor ($).

- During the Repayment Period

- The tool computes a fixed principal-and-interest payment using the standard amortization formula so the balance hits $0 by the end of the Repayment Term.

E. Update balance

- From the payment, allocate fees → interest → principal.

- Subtract the principal portion from the balance to set the next period’s starting balance.

If you prefer a quick payment view, the same steps also power the business line of credit payment calculator display in the app.

3) Key Financial Metrics (after the full simulation)

- Peak Balance

The highest outstanding balance at any point. - Total Interest / Total Fees

Straight sums of all interest and all fees posted over the life of the credit line. - Total Repayment

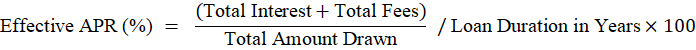

Total Draws + Total Interest + Total Fees - Effective APR (annualized cost)

This expresses the true annualized cost of borrowing based on what you actually drew and paid in charges.

Use this to compare offers and fee structures alongside the business line of credit interest calculator outputs.

Notes & Assumptions (for clarity)

- You control monthly vs weekly periods. Weekly periods increase resolution for short-cycle cash flows.

- Draws only occur in the 24-month Draw Period.

- The Repayment Period uses a fixed P&I payment based on your chosen term.

- Payment allocation order is fees → interest → principal to mirror how many agreements post charges.

- Results reflect your inputs and fee timing; check your agreement if fee posting rules differ.

Author and Review Process

This article was prepared by a financial technology writer focused on SMB finance. Content is reviewed for clarity, math, and real-world examples. We update as rate environments and lender products change.

Get Started: Try the Business Line of Credit Calculator

Model your next 12 months. Test rate moves. Pick the payment policy that fits your cash flow. Compare two offers, then export a schedule for records.