Ultimate Guide to the Home Equity Line of Credit (HELOC) in 2025: How It Works & When to Use One

What is a Home Equity Line of Credit?

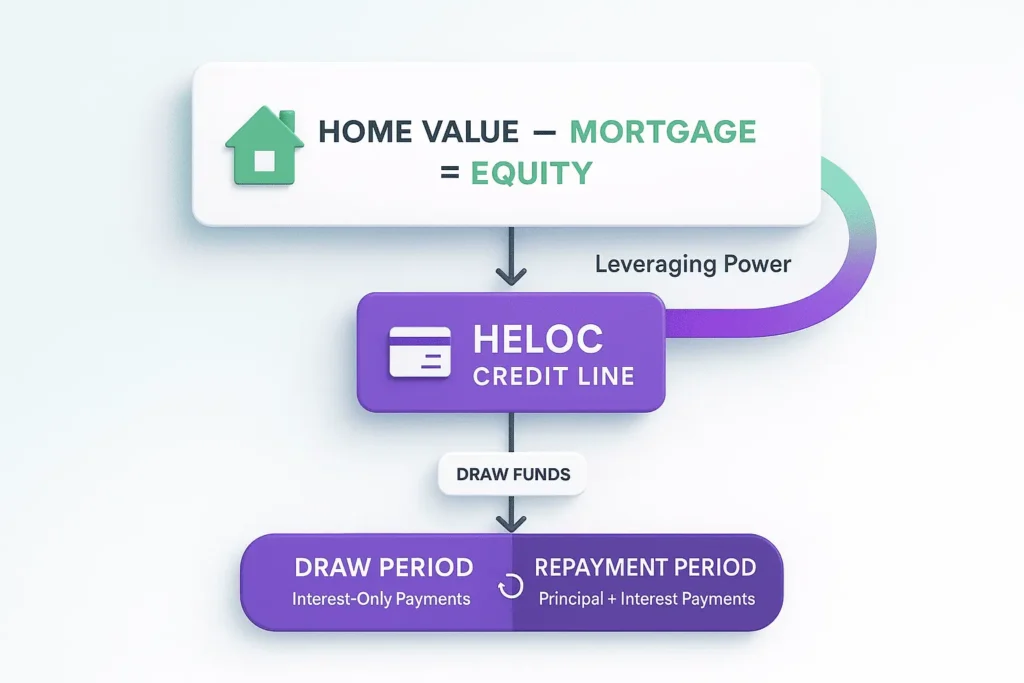

A home equity line of credit is a reusable credit line secured by your house. You tap your home equity (home value minus your mortgage balance) and receive a revolving limit that you can draw, repay, and draw again. Unlike a one-time loan, a HELOC lets you pay interest only on the portion you use, not the full line. Most lenders set a variable interest rate for a HELOC. In simple terms, APR = prime rate + lender margin. When the prime rate changes, your interest rate and minimum payments can change too. During the draw period, many plans allow interest-only payments. In the repayment period, your payment typically shifts to principal plus interest, amortized over the remaining term. Since your home secures the line, a HELOC should be treated with the same care you give your first mortgage.

Why are HELOCs popular in 2025?

Many homeowners want access to cash without touching a low first-mortgage rate. A home equity line unlocks equity on a separate track. You borrow only when you need funds, you repay on your schedule, and you pay interest on the drawn balance. That flexibility, plus clear pricing tied to the prime rate, keeps HELOCs attractive in today’s market.

Typical use cases: renovations, debt consolidation, emergency access

Renovations and home improvements: Fund projects in stages and match draws to contractor invoices.

Debt consolidation: Replace higher-rate credit card balances with a structured plan, and commit to reducing principal.

Emergency access: Keep a standby line for medical bills or urgent repairs. No interest accrues until you draw.

How a Home Equity Line of Credit Works (Draw vs. Repayment)

A HELOC is a revolving line of credit backed by your home. You access funds during a draw period, then pay back what you owe during a repayment period. Rates are usually a variable interest rate that tracks the prime rate plus a lender margin, so your monthly payments can change when prime moves.

Collateral and credit limit (equity, LTV/CLTV)

Your home serves as collateral. The size of your credit line depends on your equity and underwriting. Lenders look at LTV and CLTV.

LTV compares a single loan to your home’s value.

CLTV adds your first mortgage and the proposed HELOC, then divides by value.

Example: a $400,000 home with a $250,000 first mortgage has $150,000 in equity. If a lender targets an 80 percent CLTV, the total secured debt would be about $320,000, which leaves room for a HELOC near $70,000. Your credit score, income, and debts also influence the final limit.

Draw period mechanics (revolving line, interest-only)

During the draw period, you can take money as needed up to your limit. As you repay, the available credit replenishes. Most plans allow interest-only payments in this phase. You only pay interest on the outstanding balance, not on the full line. Because the rate is variable and tied to the prime rate, minimum payments can shift over time. Paying extra toward principal reduces interest costs and restores available credit faster.

Repayment period (amortization, payment change)

When the draw ends, the account switches to the repaymentperiod. New draws stop. Your balance is typically amortized over a set term, and payments include principal and interest. This change can increase the required payment compared with interest-only. If rates rise, the amortizing payment can move higher, since the underlying rate remains variable in many plans.

Mini example: borrowing $10,000

Assume a variable interest rate of 8 percent.

Draw period, interest-only: about $66.67 per month (10,000 × 0.08 ÷ 12).

Repayment period, amortizing over 20 years at 8%: about $83.64 per month.

Two takeaways. First, the payment usually rises when you move from interest-only to amortizing. Second, paying extra principal during the draw shrinks the balance, which lowers later payments. Use the HELOC Payment Calculator to model both phases and stress test a one or two point rate increase before you borrow.

Typical timelines

Most programs use a draw period of 3 to 10 years. The repayment period usually ranges from 10 to 20 years. Your note sets the exact schedule. Use these ranges to test long, medium, and short timelines in the calculator so you know how the payment changes when the account converts from interest-only to principal plus interest.

HELOC Rates in 2025 (Prime, margins, and Fed sensitivity)

HELOC rates are usually tied to an index plus a margin. Most lenders use the prime rate as the index. Your annual percentage rate (APR) is then calculated as prime plus the bank’s margin that reflects credit score, CLTV, occupancy, loan amount, autopay or relationship discounts, and state rules. In simple terms, your cost changes when prime changes. That is why HELOC interest rates tend to move soon after Federal Reserve policy shifts. Sites like Bankrate publish running averages, which you can use to compare rates and see how your offer stacks up.

How lenders price HELOCs (index + margin)

Think of pricing as a formula:

APR = Prime Rate + Margin.

Two borrowers can see different margins at the same bank. Strong credit, lower CLTV, and autopay can earn a lower margin. A higher CLTV or thin credit may add to it. Some lenders also offer promotional rates for a short time, then revert to the standard formula. When you model scenarios in the calculator, start with your quoted APR, then test a higher and lower prime to see the range of possible monthly payments.

Quick sensitivity check: if you carry a $25,000 outstanding balance, interest-only at 8% APR is about $166.67 per month. If prime rises and your APR becomes 9%, the interest-only payment becomes $187.50. That extra $20.83 is a simple way to see how rate changes affect cash flow.

Bank Prime Loan Rate (DPRIME) – Federal Reserve Bank of St. Louis (FRED)

Rate caps, floors, and what they mean for payments

Most HELOC agreements include a lifetime cap that sets a maximum APR and sometimes a floor that sets a minimum. Caps protect you from unlimited increases, while floors prevent the APR from dropping below a stated level. Your payment can still move within that band. During the draw period, the minimum often follows the interest-only amount at the current APR. During the repayment period, your payment includes principal, so a higher APR can raise the amortizing payment more noticeably.

Calculator tip: enter your current APR, then run what-if cases at +1% and +2%. Repeat for the repayment phase. This mirrors how lenders set pricing and gives practical guidance to compare offers and choose a line that fits your budget under different rate paths.

Eligibility & How Much You Can Borrow

Qualifying for a home equity line of credit comes down to four pillars: credit score (FICO score), income and DTI, property equity, and lender underwriting. Since a HELOC records as a second mortgage, lenders check that you can repay without straining your budget.

Credit score and DTI basics

Your FICO score helps set the pricing margin on a variable APR and can affect approval. Higher scores generally unlock better terms. Underwriters also review your debt-to-income ratio (DTI). DTI measures payment pressure using this formula:

DTI = total monthly debt payments ÷ gross monthly income.

If your mortgage, auto, cards, and student loans total $1,800 per month and your gross income is $6,000, your DTI is 30%. Lower is stronger. Lenders also verify stable income, occupancy, and property type before clearing the file.

LTV and CLTV examples (quick math walkthrough)

Two equity measures drive the maximum line size.

- Loan-to-value ratio (LTV): current mortgage balance ÷ appraised value.

- Combined loan-to-value ratio (CLTV): first mortgage plus proposed HELOC ÷ appraised value.

Example:

Appraised value: $400,000

First mortgage balance: $250,000

Assume the lender is comfortable up to 80% CLTV for illustration.

- Max secured debt at 80% CLTV: $400,000 × 0.80 = $320,000

- Subtract first mortgage: $320,000 − $250,000 = $70,000

In this scenario, the estimated HELOC limit is about $70,000. If the lender sets a different CLTV target after underwriting, your limit changes accordingly. A lower CLTV, a stronger FICO, and clean property conditions can improve offers. A higher CLTV request, a weaker score, or complex collateral can reduce the line or lead to added conditions.

Tip

Map your own numbers with this sequence. Estimate the value, check your mortgage balance, apply the CLTV from your quote, then subtract the balance to see a rough ceiling. Use that figure to test monthly payments in the calculator, starting with interest-only during the draw and then full principal plus interest during repayment.

Costs & Fees: What a HELOC Really Costs Over Time

A home equity line of credit looks simple on the surface. The true cost comes from a mix of interest, APR, and fees that vary by bank. Read the disclosures from each equal housing lender, then plug the numbers into your budget and the calculator.

Common fees (and when they are waived)

- Closing costs. Many lenders cover third-party charges such as appraisal, title search, recording, flood cert, and notary on smaller to mid-size lines. The catch is an early termination clause. If you close the line within a set window, often 24 to 36 months, the lender can recoup those costs.

- Application fees and annual fee. Application fees are less common today. An annual fee of about $50 to $75 may apply on some programs. Some waive it for the first year or for certain line sizes.

- Inactivity or minimum draw rules. A few programs require an initial draw at opening or charge an inactivity fee if the line is never used.

- Rate change mechanics. Your APR is variable, so the interest you pay changes when the prime rate changes. The agreement may include a lifetime cap and sometimes a floor. Those boundaries do not remove rate risk, but they define it.

- Other small items. Expect payoff statements and lien releases at closure. These are minor, yet worth noting when you compare offers.

Practical test. If a lender waives closing costs but charges a $75 annual fee, keeping the line open five years costs $375 even with a zero balance. Factor that into your decision.

Teasers, rate discounts, autopay benefits

- Intro or promotional rates. Some lenders offer a lower APR for a short period. After the promo ends, pricing returns to the standard index plus margin. Model both the promo and the reversion in your payment plan.

- Relationship and autopay discounts. You may earn a margin reduction for direct deposit, autopay, or a qualifying checking account. The discount looks small on paper, yet it adds up over years of payments.

- Guidance to compare lenders. Gather the margin, any fees, and recoupment rules from at least three lenders. Compare the all-in cost over the time you expect to keep the line. Then stress test payments at plus one and plus two percentage points to see which offer still fits your budget.

HELOC vs. Home Equity Loan vs. Credit Cards (Comparison Table)

Choosing between a home equity line of credit, a home equity loan, and credit cards comes down to how you borrow, how rates behave, and how you plan to repay. Use the table for a quick scan, then the notes below to match the product to your goal.

| Feature | HELOC (Home Equity Line of Credit) | Home Equity Loan | Credit Cards |

|---|---|---|---|

| Access to funds | Revolving line of credit. Borrow, repay, borrow again during draw period | One-time lump sum at closing | Revolving line up to card limit |

| Rate type | Variable-rate tied to prime rate plus margin | Fixed interest rate for the full term | Variable in practice and often higher than secured options |

| Monthly payment style | Often interest-only during draw, then principal plus interest in repayment | Fixed monthly payment of principal and interest from day one | Minimums are low and interest accrues on any carried balance |

| Collateral | Secured by your home | Secured by your home | Unsecured consumer loan |

| Flexibility | High. Draw only what you need | Low. Full amount funded once | High for small, frequent purchases |

| Typical uses | Projects in phases, cash flow smoothing, emergency access | One defined project or debt payoff with predictable payment | Short-term expenses you can pay in full each month |

| Key risks | Payment can rise with rates. Lien on home | Lien on home. Less flexibility if needs change | High cost if you carry a balance. Easy to overspend |

Simple cost lens. If you carry a balance, a secured product with a lower APR usually costs less over time. Cards can be fine if you pay the statement in full each month. If not, interest adds up fast.

When a fixed-rate home equity loan wins

- You know the exact dollar amount you need.

- You want a fixed interest rate and a steady monthly payment that never changes.

- You prefer a set payoff date without managing a draw period.

- You plan one project, one time, and do not need ongoing access to funds.

When unsecured cards or personal loans make sense (and when they do not)

Makes sense: Small purchases you can clear every month to avoid interest. A short 0 percent intro card used with discipline. A small consumer loan for a defined amount when you lack home equity.

Does not: Large balances you will carry for months. Debt consolidation without a clear plan to stop new card spending. Situations where the card APR far exceeds secured options and you will pay interest for an extended period.

Tip for your plan:

If you are unsure about rates, model both a HELOC at your quoted APR and a fixed home equity loan with the same amount. Compare total interest and the payment you can live with under a realistic timeline.

Pros, Cons & Risks of a Home Equity Line of Credit

A home equity line of credit gives you flexible access to cash at a cost that is often lower than unsecured debt. It is also serious borrowing secured by your house. Treat it like a second mortgage with rules you fully understand.

Key advantages

- Flexibility when timing matters. Draw only what you need during the draw period, repay, and draw again as projects evolve. You pay interest only on the amount outstanding, not on the full line.

- Lower cost vs. unsecured options. Because the line is secured, the APR usually undercuts personal loans and credit cards. When you compare offers, small margin differences create meaningful savings over time.

- Cash flow control. Many plans allow interest-only payments during the draw period. That can help you manage expenses while you complete a remodel or wait for an insurance reimbursement.

- Possible tax benefit. Interest may be tax-deductible when funds are used to buy, build, or substantially improve the home that secures the line. This is a tax topic. Talk to a qualified advisor for your situation.

Key risks

- Variable interest rate. Most HELOCs follow the prime rate. If rates rise, your required monthly payments rise. Even a one point change can be felt on larger balances.

- Payment shock at conversion. When the draw ends, you enter the repayment period. Payments switch to principal plus interest and can jump compared with interest-only.

- Your home is collateral. Late or missed payments can trigger default remedies. Budget with the same care you use for your first mortgage.

- Line adjustments. Lenders can reduce or freeze a line in limited circumstances, such as a significant drop in property value or changes in credit profile. Plan for a backup.

Tips to avoid the debt spiral

- Borrow with a purpose. Write down the exact use of funds and the payoff horizon before you draw.

- Pay principal early. Add a fixed extra amount each month during the draw period to shrink the balance before amortization begins.

- Stress test the rate. Model +1% and +2% in the calculator to confirm the payment still fits.

- Cap yourself. Set a personal CLTV ceiling that keeps room between total secured debt and value.

- Consolidate with discipline. If you pay off cards using a HELOC, pause new card spending until the HELOC principal is materially lower.

- Know your fees and terms. Note any annual fee, early closure recoupment of closingcosts, and lifetime cap or floor on the APR.

Used with a plan, a HELOC can lower financing costs and keep projects moving. Used casually, it can extend debt and crowd your budget. The difference is the repayment strategy you set on day one.

Smart Uses of a Home Equity Line of Credit (When it makes sense)

A home equity line of credit works best when you match it to clear goals and a defined payoff plan. Use it where flexibility and phased funding beat a lump sum, and where you can handle the monthly payments even if the rate moves.

Value-add projects vs. lifestyle spending

Home improvements are a strong fit. Draw in stages as invoices arrive, and align payments with your budget. Kitchens, roofs, energy upgrades, and repairs that protect value are sensible targets. Model interest-only in the draw period, then check the repayment amount in the calculator so you know how fast you will reduce principal. Avoid lifestyle spending. Vacations, gadgets, and furniture rarely justify pledging your home. If you need a fixed amount and a fixed interest rate, a home equity loan may be the better tool. If you were considering a cash-out refinance, compare carefully. Keeping a low first-mortgage rate and adding a HELOC can cost less than replacing the entire loan.

Emergency access vs. emergency fund

A HELOC can act as a backup credit line for true emergencies. It costs little to keep open when unused, and it can bridge short gaps for medical bills or urgent repairs. It should not replace a cash reserve. Build a cash emergency fund first so basic needs do not rely on borrowing. Remember that lenders can change a line in rare cases, so keep some savings for stability. For debt consolidation, a HELOC can help if you commit to no new card balances and schedule extra principal payments. The simple test is this. Write down the purpose, the target payoff date, and a number you can afford each month at today’s APR and at plus one percent. If both numbers work, the use case likely makes sense.

Taxes & Deductibility (HELOC Interest Rules)

HELOC interest can qualify as mortgage interest for tax purposes, but only in specific situations. The short version is this. Interest may be tax-deductible if you use the funds to buy, build, or substantially improve the same home that secures the line, and if you itemize deductions. The deduction is also subject to overall mortgage interest limits set by the IRS. Your principal payments are never deductible.

IRS Publication 936: Home Mortgage Interest Deduction

When interest may be deductible (improvements)

Use the line for home improvements that add value or extend the life of the property. Think roof replacement, kitchen remodel tied to permits, energy upgrades, or structural repairs. Keep a clean paper trail. Save contractor agreements, paid invoices, and bank statements that show HELOC draws going to the project. If part of a draw covers improvements and part covers something else, expect your tax preparer to trace the improvement portion only.

When it is not deductible (debt consolidation, tuition)

Using a HELOC for card payoff, tuition, medical bills, vacations, or investments generally does not qualify for the mortgage interest deduction. The IRS focuses on how the money is used, not only on the fact that the loan is secured by your home. If the use is not to buy, build, or improve the secured home, the interest typically is not deductible.

Important: Tax rules change, and individual limits apply. Before claiming any deduction, speak with a qualified tax advisor who can review your loan terms, usage, and documentation.

How to Get a HELOC (Step-by-Step)

Getting a home equity line of credit is straightforward once you know the sequence. Most programs at a bank or credit union follow the same core stages. Examples include national brands such as U.S. Bank or Bank of America, both listed as Equal Housing Lender on their disclosures.

Pre-qual to account setup

- Pre-qualification. Share your address, estimated value, and FICO score range. You receive an initial estimate of line size, pricing, and any application fees. Some lenders waive the fee or credit it at closing.

- Application. Complete the full form and consent to a credit pull. Upload income and property documents. Choose autopay and relationship options if you want margin discounts.

- Appraisal. The lender orders a valuation. It can be an exterior inspection, a desktop review, or a full interior visit, depending on policy and line size.

- Underwriting. An underwriter reviews income, DTI, CLTV, title, and insurance. Questions are common, so respond quickly to keep the file moving.

- Approval and closing. You receive final terms, sign disclosures, and complete any funding requirements such as an initial draw if the program calls for it.

- Account setup. Access the line of credit through online banking, checks, or a debit card. Confirm your draw and monthly payments schedule before the first billing date.

Tips to speed approval

- Documents checklist. Government ID, recent pay stubs, W-2s or 1099s, two years of tax returns if self-employed, two months of bank statements, your current mortgage statement, homeowner’s insurance policy, property tax bill, and HOA statement if applicable.

- Accuracy first. Match names and addresses across all documents. Small mismatches trigger conditions.

- Be responsive. Upload requested items within 24 hours. Fast replies shorten underwriting time.

- Plan for the appraisal. Keep the property accessible and provide recent improvement details.

- Know your numbers. Verify income and debts before you apply, then test payment scenarios with your quoted APR so you can accept an offer confidently.

Most files move faster when the application arrives complete, the appraisal is scheduled early, and all questions receive same-day responses.

Use Our HELOC Payment Calculator to Avoid Surprises

Our calculator shows the two lives of a HELOC. During the draw period you can make interest-only payments tied to your current interest rate. During the repayment period the balance is amortized, and the monthly payment includes principal and interest. You see both views side by side, which makes planning easier.

What you will see: draw vs. repayment

Enter your line amount, current draw, APR and timing. The tool displays:

- Interest-only payment for the draw period at the selected APR.

- Amortizing payment for the repayment period.

- Running totals so you can compare cash flow between phases and decide how much to borrow from your available equity.

Mini example. Suppose you draw $20,000 at 8% APR.

- Draw period, interest-only: about $133.33 per month.

- Repayment period, 20-year amortization at 8%: about $167.29 per month.

Test +1% to 9% APR and the amortizing payment becomes about $179.95. That quick check shows how rate changes affect your budget.

Try “what-if” scenarios

- Rate moves: Run +1% and +2% cases to see payment ranges. Use this as guidance to compare rates across lenders before you open the line.

- Extra principal: Add a small extra payment during the draw or repayment period. In the example above, adding $50 to the 8% amortizing payment cuts payoff to roughly 12 years and can save thousands in interest over time.

- Balance planning: Adjust the draw amount to keep your future payment within a number you can live with in both phases.

Open the HELOC Payment Calculator and model your own numbers. Start with today’s quoted APR, then test a higher and lower rate so your plan still works if the prime rate changes.

Real-World Examples & Mini Case Studies

Remodel scenario: phased draws for home improvements

Maya plans home improvements totaling $60,000 across three stages over nine months. She opens a HELOC at 8% APR and draws only when invoices arrive.

- Phase 1 draw $20,000. Interest-only is about $133.33 per month.

- Phase 2 adds $25,000. New interest-only is about $300.00 per month on $45,000.

- Phase 3 adds $15,000. Interest-only rises to about $400.00 on $60,000.

When the draw ends, she chooses a 20-year repayment. At 8% the amortizing payment is about $501.86 per month. If she instead chooses 15 years, the payment is about $573.39 and the total interest drops. She can prepay principal during the draw to lower both numbers. This approach fits projects with multiple milestones because she is not paying interest on funds she has not used. It is also easy to model. Enter each staged draw in the calculator, then compare 15 vs 20 years.

Debt consolidation scenario: card to HELOC with discipline

James has $18,000 on credit cards at 23% APR. His card minimum is about 2% of the balance ($360), which barely reduces principal since monthly interest is about $345. He opens a HELOC at 9% APR and commits to a five-year payoff schedule.

- HELOC amortized over 5 years at 9%: about $373.65 per month.

- Keeping the card and paying off in 5 years at 23%: about $507.43 per month.

The HELOC plan frees about $133 per month and sets a clear finish line. It only works with discipline.

Discipline checklist

- Freeze new card spending until the HELOC balance is small.

- Automate payments and add a small extra toward principal each month.

- Recheck APR scenarios at +1% and +2% to confirm the plan still fits.

- Review refinance alternatives only if costs are justified and your first mortgage rate would remain attractive.